A new future for Formula One, or the same old-school sport simply repackaged by new owners?

Following Liberty Media’s $8bn takeover, this is the core debate at the centre of new season activation starting at the 2017 Australian Grand Prix in Melbourne.

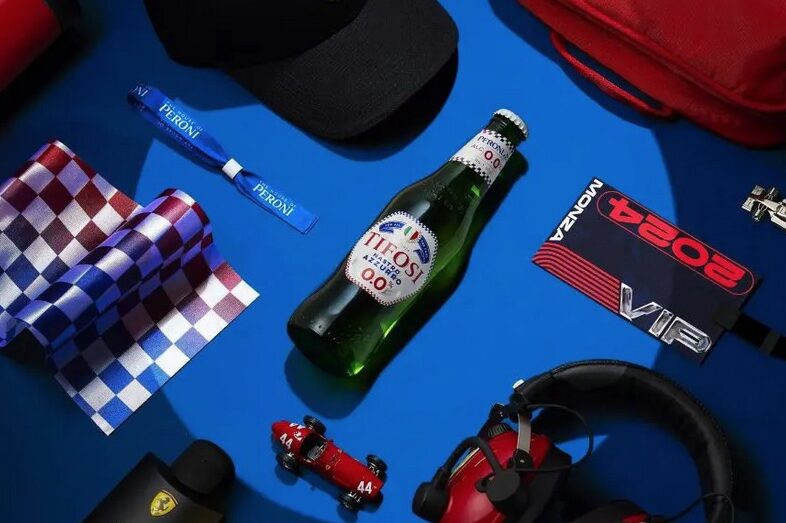

While official F1 beer Heineken seemed to mix the new and the old in its ‘More Than A Race’ Australian ticket giveaway which mixed futuristic innovative interactive billboards with an old school challenge to join the traditional F1 jet-setting A-list elite, UK broadcaster Channel 4’s trailers focus exclusively on the sports new future and fresh changes.

Other new season kick-off work simply featured F1 drivers in crazy whacky races (eg team campaigns like Red Bull Racing’s ‘Dinghy Race’ and sponsor activations such as the Chandon (McLaren) ‘Unexpected Race’. More…

F1 Stat Snapshot

$8bn > What Liberty Media Paid To Buy The F1 Commercial Rights

$750m > Sponsorship Revenue In 2015

$950m > Sponsorship Revenue in 2011

400m > F1 TV audience in 2016

600m > F1 TV audience in 2008

Liberty Media’s F1 Objectives

1: Refresh The Brand

2: Embrace Digital/Social

3: Democratize Decision-Making

4: Re-Imagine The Race Experience.

Formula One has long been an anachronistic contradiction: a high-tech, cutting-edge sport on the race track, but an old-school, conservative property off-track in terms of engagement, marketing and sponsorship.

But, after Liberty Media spent $8bn to buy the rights last year, 2017 might be the year that the two sides of the sport start coming back into line.

New Strategies: TV, Reach & Sponsorship

If Liberty Media’s strategy objective is to build the brand, boost the audiences and increase the numbers of sponsors – then digital and social expansion is an obvious tactical route towards achieving this if the sport sticks to pay-TV broadcast deals.

After all, its viewing audiences have steadily declined in several key territories since it began switching to pay-TV.

The sport’s falling broadcast reach has seen to lose 250 million viewers in the last eight years (and circuit attendances have been shrinking too).

Formula One’s broadcast revenue may have grown and it is reported to now account for around 35% of its income: but the profits generated from pay-TV deals can be reduced by the lower sponsorship revenues that typically come with lower reach.

Indeed, sponsorship revenue for the teams has been dropping for several years: in 2015 it totalled $750m – a major drop from $950m just three years before.

Formula One’s new commercial managing director Sean Bratches suggests the new owners will focus on redeveloped digital assets to generate the levels of audience reach that its former free-to-air partnerships used to provide and help convince sponsors that it still yields a valuable reach.

‘Sports organisations are finding themselves on pay [TV] because that is where the money is,’ admits Bratches.

‘We are in the process right now of re-imagining our entire portfolio of digital assets from web, apps, to social, to OTT – and we really look at that as an opportunity to engage with fans on a very broad basis and really navigate fans around our eco system, in and outside a grand prix weekend. We are not looking at fan engagement from any one specific platform, we are looking at it holistically. And with the advent of digital and broadband and interconnectivity, and the adoption of digital, we think that is a big opportunity to complement and augment markets where we do tend to go a little bit more in the pay direction.’

‘Formula 1 has an exciting and innovative vision for the sport. We want fans to get closer to the action on and off the track, with new levels of entertainment and engagement,’ adds new Formula One director of global communications Norman Howell.

‘If we can do this, Formula 1 will continue to be one of the biggest sporting brands in the world.’

Digital & Social (Video)

One of the key early changes since Liberty Media took over from Bernie Ecclestone is that the rights holder has relaxed its restrictions on teams using digital and social to distribute video content.

Teams took advantage of the new engagement option at the earliest opportunity – pre-season testing in Barcelona.

#F1Testing, Day 1: afternoon – we are GO! pic.twitter.com/rN2dQz9U6o

— Renault Sport F1 (@RenaultSportF1) February 27, 2017

Like you've never seen before: #SF70H pulling off the garage #Kimi7 #F1Testing pic.twitter.com/YbB8qXyFqA

— Scuderia Ferrari (@ScuderiaFerrari) March 8, 2017

The previous regime had forbidden teams and their sponsors to post videos to social media as it kept an iron grip on ensuring all footage was exclusive to broadcast partners and this change seems like a positive first step in a whole new approach to digital and social opportunities (both in terms of fan engagement and monetisation) for a sport stuck for so long in the TV rights era.

This is particularly vital to a sport that has lost so much mass market reach after putting its TV rights up for sale to the highest bidders and seeing pay-TV channels snap them up rather than free-to-air broadcasters.

First it’s testing, but many expect many more strands of the sport to start opening up to more of the media that the vital millennials favour.

Marketing & Sponsorship Rethink

Indeed, Ecclestone seemed largely uninterested in social media (some say he was ‘naive’ about it) and insisted on draconian regulations on rights.

After 40 years running the show, the 86-year-old F1 supremo wasn’t quite keeping up with the times.

In fact, he largely saw sponsorship within the sport as the responsibility of the teams rather than of the rights owner.

This is reflected by the fact that there was no dedicated sponsorship and management unit within Formula One’s Knightsbridge headquarters.

But this is all changing under the new management: which is busy recruited dedicated and experienced partnership professionals and will be more proactive on everything from commercial partnerships and digital/social, to celebrity influencer and athlete ambassador marketing.

Indeed, the sport looks set to shift to a more rounded entertainment offering: with a more festival-style atmosphere and a more open (less elitist) approach at races.

Races look set to become more like a 21-stop global tour of three-day festivals combining world-class motor sport with celebrity, fashion, music and technology.

Global Growth, But Which Regions Will Be The Focus?

Geographically, the task will span re-connection and expansion.

This means re-establishing the sport in its core markets by re-connecting with its traditional fan base and embracing its iconic, classic circuits (like Monza, Spa, Hockenheim and Silverstone).

Plus, perhaps focusing on growth in regions such as Latin America, Asia and most particularly the USA (more than on the somewhat soulless, yet high paying races in the Middle East which made much less sense for many of the sport’s sponsors).

Oh, And Better Racing Too

The new owners will also need to try and provide a better product on the track – specifically more exciting racing.

The appointment of Ross Brawn is seen by many as recognition that the racing needs fixing – for the sake of the fans and the stakeholders.

This will be a major challenge: Brawn may have to tackle everything from the cars and engines, to the currently uneven and unfair income distribution between the teams in order to close the vast chasm between the rich teams and the runners at the back of the field.

Melbourne Marks A New Marketing Start?

Judge for yourself: check out some of our five favourite campaign case studies from the first race of the new Formula One season – the Australian Grand Prix in Melbourne.

1: Heineken ‘More Than A Race’

2: Chandon/McLaren ‘Unexpected Race’

3: Swisse Wellness/Ferrari ‘Power Your Passion’

4: Red Bull ‘Dinghy Race’

5: Channel 4 ‘Race Into The Unknown’

6: Casio/Scuderia Toro Rosso ‘Time Trial Challenge’

Activative’s Top 10 Favourite F1 Campaigns

1: Honda ‘The Sound Of Senna’ (2014)

2: EMC/Lotus ‘Truck Jump’ (2014)

3: Vodafone/McLaren ‘Taxi GP Game’ (2009)

4: Vodafone/McLaren ‘Super Hero Comic’ (2012)

5: Red Bull Racing ‘360 Consumer Controlled Camera’ (2012)

6: Esso/McLaren ‘Fuel Your Senses’ (2015)

6: Santander/McLaren ‘#SecretSantander’ (2015)

7: Bose/Mercedes ‘F1 Garage Experience’ (2016)

8: Mexican GP ‘#BridgesNotWalls’ (2016)

10: F1 ‘8-Bit’

Whether this was a statement about how social media is oversaturated, or just an illustration of Formula One’s distinctly old-school approach to advertising, marketing and commercial partnership, we still liked the rights holder’s simplistic 8-Bit recap of the 2016 season.

If 2016 in F1 had been an 8-bit video game

Anyone wish they had a controller? #F1 pic.twitter.com/GN6k02nnPK

— Formula 1 (@F1) December 12, 2016

Links:

Formula One

https://www.facebook.com/Formula1